Options are derivative contracts that provide its holder with the right to buy or sell an option’s underlying asset without the obligation to do so. This buying or selling is done at a predetermined price, known as the strike price and needs to be carried out on or before the expiry of the contract.

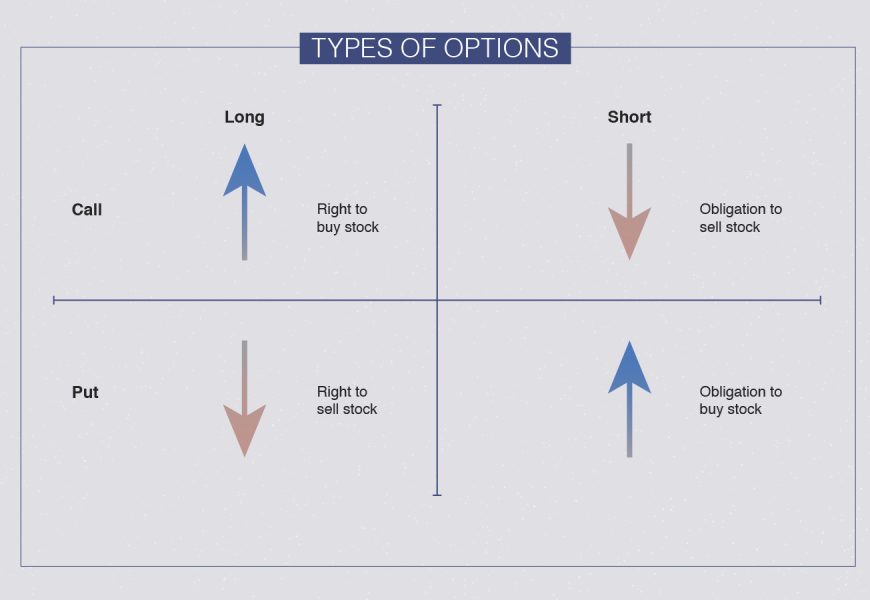

There are two types of options contracts; call options and put options. In this blog, we will take a look at both of them and help you understand them better.

Understanding Call Options and Their Working

With the help of a call put option, the option holder has the right to purchase the underlying asset at the strike price. They do not need to exercise this right, however, but if they choose to, they need to do so before the expiry of the option.

The call option is a versatile derivative contract that enables various securities to become the underlying asset in an option. This includes securities like ETFs, currencies, etc. Under a call option, the option seller or writer makes a deal with the investor looking to buy the option.

If the call option has equity as an underlying asset, there are usually 100 shares per contract. The one expense that a call option buyer has to pay, without fail, is the option premium to the option seller. Though the market value of the option itself is decided by the option seller and option buyer, the price of the underlying asset is determined by the market.

The buyer of a call option earns significant returns when the price of the underlying asset crosses the strike price before the option expires. In this context, the profit earned is the difference between the stock price and the option’s strike price.

Understanding Put Options and Their Working

With a put option, the option holder is given the right to sell or write the underlying asset at the strike price. They, however, do not need to exercise this right, but if they choose to, they need to do so before the expiry of the option.

The main motive behind purchasing a put option is the investor’s belief in the potential decrease of the underlying asset’s price, before the option’s expiry. Conversely, puts are sold when the investors sense a potential for the underlying asset’s price to increase.

If the call option has equity as an underlying asset, there are usually 100 shares per contract. The one expense that a call option buyer has to pay, without fail, is the option premium to the option seller. Though the market value of the option itself is decided by the option seller and option buyer, the price of the underlying asset is determined by the market.

The buyer of a call option earns significant returns when the price of the underlying asset crosses the strike price before the option expires. In this context, the profit earned is the difference between the stock price and the option’s strike price.

The chances of a put option gaining more value always exist, enabling the option seller to increase the option premium, i.e. with a declining stock price of the underlying asset, the premium of a put option rises. As an alternate reality to this is the fact that with decreasing option premiums of put options, the stock price rises considerably.

The main reason investors choose to invest in different types of options is when they sense that the price of the underlying stock will decrease.

Conclusion

Both call and put options are the two different types of options contracts that need to properly be understood in order for investors to make use of them better and more profitably.