In the rapidly evolving world of business, organizations require advanced tools to stay ahead in managing their financial operations. Dynamics 365 Finance by Microsoft is one such tool designed to streamline financial management, improve decision-making, and ensure better financial control for businesses of all sizes. This cloud-based solution integrates financial data across the enterprise, helping finance teams manage accounting, budgeting, forecasting, and reporting in a unified environment.

What is Dynamics 365 Finance?

Dynamics 365 Finance is a part of the Microsoft Dynamics 365 suite of business applications. It focuses on automating and modernizing core financial processes such as general ledger management, accounts payable, accounts receivable, and fixed asset management. By leveraging intelligent technology, it helps businesses to gain deeper insights into financial data and improve financial performance.

This comprehensive software solution enables companies to unify their financial data with real-time access and forecasting. Its cloud-based infrastructure ensures that businesses can scale their financial management capabilities as they grow.

Key Features

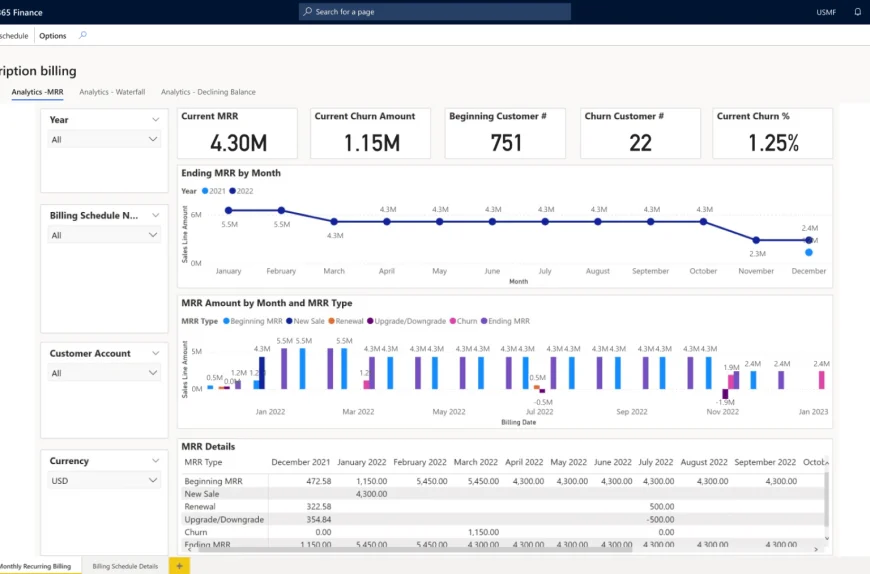

- Financial Reporting and Analytics

One of the standout features of Dynamics 365 Finance is its powerful reporting and analytics tools. It provides real-time visibility into financial performance, empowering businesses to make informed decisions. With customizable dashboards and reports, you can gain insights into financial health, track key performance indicators (KPIs), and forecast future trends. - Budgeting and Forecasting

Financial planning is essential to any business, and Dynamics 365 Finance provides advanced tools for budgeting and forecasting. The platform uses AI-driven insights to project future financial performance, enabling organizations to plan more effectively. This helps reduce risk and improve the accuracy of financial predictions. - Accounts Payable and Receivable

Managing accounts payable and receivable is simplified with Dynamics 365 Finance. The platform streamlines invoicing, payment processing, and collections, reducing manual effort and errors. Automation of these tasks speeds up workflows, reduces operational costs, and improves cash flow management. - Financial Close and Consolidation

Dynamics 365 Finance facilitates faster financial closing and consolidation. It helps organizations close their books efficiently by automating the process of consolidating financial data from different departments and subsidiaries. This ensures that financial reports are accurate and prepared on time, reducing the month-end stress. - Compliance and Risk Management

Keeping up with regulations and ensuring compliance is a challenge for any finance department. It comes equipped with built-in compliance and risk management tools to help businesses adhere to industry regulations. It helps track changes in tax laws and provides tools for internal auditing, mitigating financial and legal risks.

For more blogs: andersontomorrow

Benefits of Using Dynamics 365 Finance

- Improved Financial Visibility

With this, businesses can have a comprehensive view of their financial status. This transparency helps executives make strategic decisions, manage cash flow, and monitor financial health in real time. - Enhanced Efficiency

The automation of routine financial tasks, such as invoicing and payments, allows finance teams to focus on more strategic activities. This leads to improved productivity, reduced manual errors, and lower operational costs. - Scalability

As businesses grow, their financial management needs become more complex. Dynamics 365 Finance scales with the organization, offering a flexible solution that can be tailored to meet changing business demands without the need for a complete system overhaul. - Better Decision-Making

By integrating real-time data, analytics, and AI capabilities, Dynamics 365 Finance enables better decision-making. Finance leaders can access accurate and up-to-date information to make informed decisions about investments, budgeting, and cost management. - Seamless Integration

It is designed to integrate seamlessly with other Microsoft applications, such as Microsoft Power BI and Office 365. This ensures that businesses can work with their preferred tools while maintaining a unified view of their financial operations.

Dynamics 365 Finance and Its Impact on Business Operations

The implementation can significantly improve various aspects of business operations. By automating manual tasks, reducing operational risks, and providing insights into financial data, businesses are empowered to make smarter financial decisions. The cloud-based nature of the platform also ensures that financial data is always accessible, secure, and up-to-date.

Moreover, Dynamics 365 Finance supports global businesses by providing multi-currency, multi-language, and multi-country financial capabilities, allowing organizations to operate efficiently across borders. With a highly customizable interface, businesses can tailor the system to fit their unique needs and processes.

For more blogs: andersontomorrow

Conclusion

In conclusion, Dynamics 365 Finance is an essential tool for businesses looking to modernize their financial management practices. From real-time financial reporting to AI-driven insights, the platform offers a wealth of features that help companies reduce costs, improve decision-making, and streamline processes. By leveraging Dynamics 365, businesses can take control of their financial operations and prepare for sustainable growth in today’s competitive landscape.